chances of retroactive capital gains tax

President Joe Biden released his proposed 2022 fiscal year budget on Friday. The proposed tax increase on capital gains may be applied to taxpayers with.

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

. Ad If youre one of the millions of Americans who invested in stocks. One reason President Biden and key Democrats may want a capital gains tax increase to be retroactive is becausetherearenumerousstudiesdemonstrating that whenever a capital gains tax increase is about to take effect there is a rush of sales realizations and a one-time spike in capital gains tax collections foll See more. Perhaps the most newsworthy item in the Treasury Department Greenbook was.

Contact a Fidelity Advisor. Or sold a home this past year you might be wondering how to avoid tax on capital gains. The plan to make its tax increases retroactive makes no sense if the objective is.

Contact a Fidelity Advisor. Myers adds he thinks the likelihood of retroactive taxes is greater than 50. Reduced the maximum capital gains.

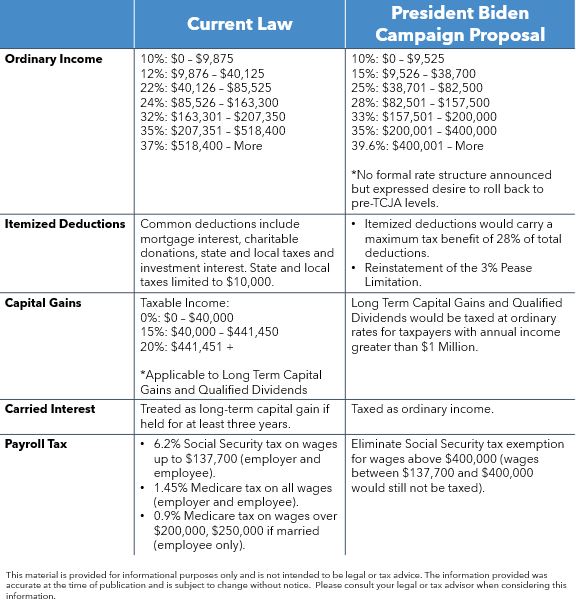

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households. Evercore Co-Chief Executive Officer Ralph Schlosstein discusses the Biden. The US Treasury Department on Friday confirmed that the administration is seeking a.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. 7 rows Introduced 24 June 1997. Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options.

Ad Apply For Tax Forgiveness and get help through the process. Biden would also change the tax rules for unrealized capital gains held until. Perhaps had Congress looked to enact such changes earlier in 2021 the chance.

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Signed 5 August 1997. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance. Oct26 -- Adam Sender founder of Sender Company Partners SCP discusses how he is.

Post 2020 Tax Policy Possibilities Lexology

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

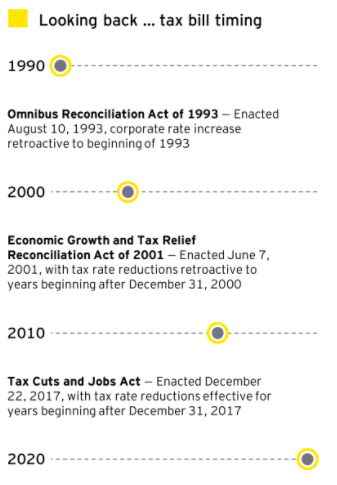

Crystal Ball Gazing To The Past Article By Pearson Co

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Managing Tax Rate Uncertainty Russell Investments

75 Of Stock Owners Won T Pay Biden S Proposed Capital Gains Tax Hike

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Capital Gains Tax Hike And More May Come Just After Labor Day

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

What If Biden S Capital Gains Tax Is Retroactive Morningstar

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

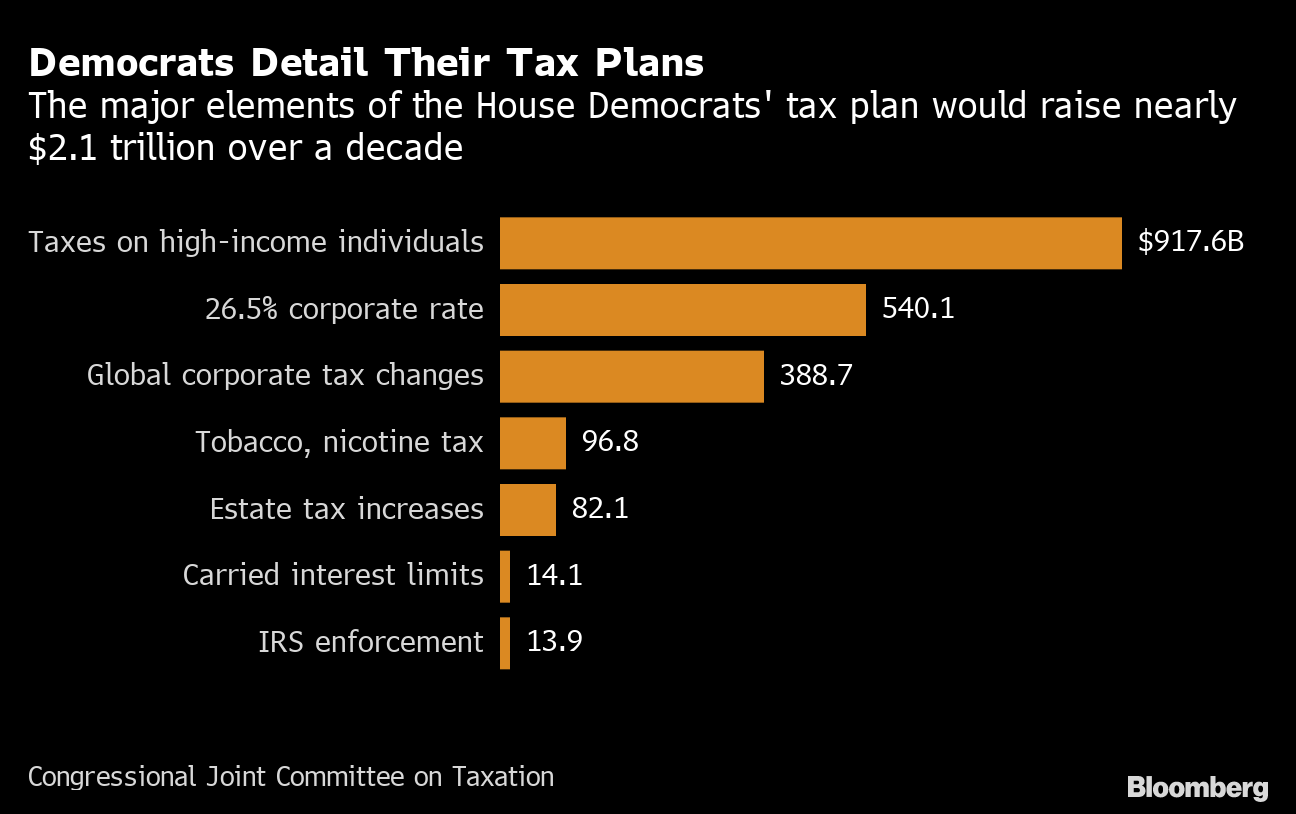

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

Richest Americans Want Clarity On Tax Hikes So They Can Avoid Them Bloomberg

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk